Call Tony to arrange viewing on 0800 61 8888

Asking $249,000 - SOLD

]]>

First home buyers and those selling homes are about to benefit from first home buyer packages being offered on the market as of today. The lending market is certainly heating up, with more competition from the banks they are really out there trying to buy your business now which is a complete turnaround from earlier this year.

Mortgage Express, our lending partner reports that ne of the main stream banks launched a new incentive package for First Home Buyers yesterday consisting of:

* up to $1000 towards legal fees

* A voucher for Noel Leeming’s

* Application fees will be waived

* Free AP and bill loading for 3 months

* Credit card fee waived for the first year - specific to new cards only

* True rewards fee is also waived – this is specific to new True Rewards accounts

It is a great time for customers to buy with good packages on offer from the banks, 95% lending, legal fee contribution and great rates and discounts.

We can help you get your first home, cal us and we’ll help you make your move!

]]>With the banks economists predicting one thing and the rates doing the opposite, it is quite confusing at the moment to try and understand what the rates might in the future, especially so for first time buyers. The ASB Economists had this to say:

The Reserve Bank of New Zealand (RBNZ) began lifting the OCR by 25 basis points in both June and July, bringing the OCR to 3%. We expect the RBNZ to take a break from lifting the OCR in October and December. We expect rate hikes will resume in January, with the OCR steadily increased by 25 basis points at each meeting until the OCR reaches 4.5%.

Following the lifts in the OCR, floating rate mortgages have started to increase, and we expect the floating mortgage rate to continue to rise over the next year in line with future OCR rate increases. This may prompt some borrowers to move to fix the floating part of their debts. Our calculations suggest there is not much cost difference over a 2-year horizon between floating and fixing. This means the certainty of short-term fixed rates now comes at very little cost. In addition, the recent decline in the 2-year rate does marginally increase its attractiveness, although we do emphasise a large degree of uncertainty remains around the pace of OCR increases over the next year.

Beyond the 3-year mark, fixing remains expensive (despite recent declines in rates) but there is the benefit of more certainty if that is an important factor in the decision. Indeed, if this is something you are willing to pay a premium for, then now is an opportune time to fix as there is no guarantee 3 to 5 year rates will remain this low for long.

The trend over the next year will be for shorter-term mortgage rates to start lifting back to average, or slightly above-average rates. With long-term fixed rates relatively high, it is really only the floating or short-term fixed rates that offer value. Priority will be dictated by borrowers’ preference for maximising the chance of low debt servicing costs or smoothing the inevitable increase in mortgage rates.

Current rates:

Floating 6.10% Westpac Choices

6 months 6.25% Wpac

1 year 6.45% All banks

2 year 6.85% All banks

3 year 7.15% National Bank

4 year 7.45% ASB & Wpac

5 year 7.75% All banks

BNZ remains of the opinion that unless sharemarkets collapse another 20% in the next fortnight the Reserve Bank will raise the official cash rate (OCR) 0.25% on June 10 and indicate plans to raise the rate steadily from then on.

“But with an eye to changing the pace if conditions turn out to be weaker or stronger than they expect,” he says.

The advice for borrowers is to

still toss a coin between staying floating and opportunistically hopping into a one to three year fixed rate.

Alexander says at the margin the risk remains that the Reserve Bank does not take the official cash rate in a straight line manner to the 6% level it has pencilled in for early 2012 and that suggests those choosing to stay floating won’t necessarily be worse off than fixing out to then.

“Note as ever however that no-one can avoid higher funding costs if they face a fixing decision now because of the risk floating rates are near their peaks in three years time,” he says.

Our advice at this stage is to hedge your bets and split your loan. If you would like some of advice or have a question please just ask Suzanne Isherwood on 0800 226 226!

]]>

The million dollar question that

we are asked at the moment is

“what do you think will happen to the interest rates

this year, how high will they go?”

A lot of people are uncertain about what’s happening with interest rates so they are going on the floating rate to watch and wait. People are doing a mixture of variable and fixed rates and we want to make sure when they look at what’s available they see they get a good rate.

One of the major banks says most people are looking to fix because it is perceived that rates will go up in the middle of the year, however there is still strong demand for the floating rate with 40% of drawdown’s on the floating rate.

Another economist says we are seeing a change in the floating rate now because of weak data and unemployment numbers which suggest the official cash rate, which is at a record low of 2.5%, won’t rise until June. Previously many economists were expecting a rise in March or April. He says if any other banks make movements he expects them to be minor because there has not been much of a change in 90-day bank bill yields and it is more expectations of them changing rather than the immediate cost of borrowing changing.

He believes the option of floating looks best for most people and as we approach the time when floating rates start rising – mid-year – for a while the optimal thing may be to fix one year, as many are still choosing to do at the moment. His advice for borrowers is to budget for about a 3% rise in floating rate borrowing costs between the middle of this year and the end of 2011.

No change from last week with Interest Rates of the week:

6 months 5.69%

12 months 6.15%

18 months 6.60%

24 months 7.20%

36 months 7.79%

48 months 8.49%

60 months 8.60%

ASB however did move down their rates this week, which is a welcome change as they have been leading the charge with rates going up!

]]>

The Three Auctioneers

During the week I met a client of mine who is considering whether to sell. We have talked about this sale over the last two or three years. She asked me, “Is now the right time?”, and then she said ” Stop being a real estate agent and tell me what you really think”.

I laughed- real estate agents are so full of bluff and bluster, (I’m being polite)-it sometimes is hard to know when we are being real or just spouting a line to get a listing! So I said, “You want me to be enthusiastic and positive, don’t you?!”

So, Is it really the right time to sell? Well, it’s your house, your land, and it really is up to you. I can only help you get the very best price for your house when you decide the time is right for you.

However, there are market factors, right now, that indicate that it is a good time to go to the market. Let’s look at the evidence on a national basis, locally and how it might affect you, today.

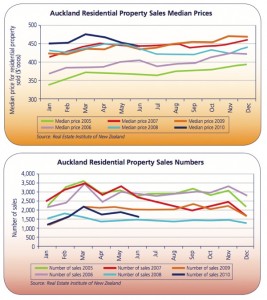

After two years of the ball being very firmly in the buyers court, real estate commentator Alistair Helm of realestate.co.nz says the market is stable and swinging towards a sellers market, but there is a real danger of lack of stock driving up prices. The NZ Property Report, dated 1 Sept 2009, shows a clear lack of houses on the market, especially in the main centres. Auckland is the worst off, there are 45% (almost half) the number of homes on the market as there were a year ago. And this shortage of property for sale will drive up prices. One of the really scary things is that there are few homes being built, and little land being subdivided. Watch out!

Yet Auckland is New Zealand’s biggest city and the landing pad for most immigrants and returning ex pats. These buyers have cash and they are actively in the market buying homes with British Pounds and Chinese Yuan. Often this money is secured against overseas assets and borrowed with low interest rates. It is one of the reasons why the New Zealand Dollar is high. Overseas buyers have always valued New Zealand land and property highly, often higher than the locals ( think of British migrants in 1840, buying land from the locals for a few blankets!). And while local interest rates are the lowest we have seen for decades, they are forecast to rise in the New Year, so buyers are buying and fixing their rates. Remember a loan in 2009 costs a third less than the same loan did a year ago.

So, locally, on the North Shore, there is a boom. How long will it last? I don’t know, you tell me. The auctions I have attended have been active and exciting. At 89 Forrest Hill Road, Forrest Hill about 200 people witnessed a battle royal. 3 bidders fought over an 1800m2 section with an original 1950′s weatherboard bungalow. It sold for $1,200,000. I have attached the bid sheet for you to see. 7 Trafalgar Road, Milford, a brick and tile 1960′s home, nicely renovated, with a pool, sold after a fiercely contested bidding war, for $900000. And 60 Kowhai Road, Mairangi Bay, sold for $855,000 3 weeks before the auction. The buyer made the sellers an offer they could not refuse, to avoid missing out (again).

Not every home is right for auction however, and some are more difficult to sell than others. If you are needing some advice, without bluff and bluster, call me.

Is now the right time to sell? The market evidence says YES.

Is it the right time for you? Only you can answer that.

If the answer is YES, give me a call on 0800618888.

]]>